CONTEXT

Our client, a major Australian Bank, was severely underperforming in its core mortgage product. It experienced below system mortgage growth in a rapidly expanding market, poor relative market share and higher than average levels of non-performing loans. Constrained by an end-to-end mortgage process that was highly manual and paper based, and that was underpinned by antiquated systems, its mortgage offer could not competitively satisfy key customer buying criteria, particularly with respect to its ‘Time to Yes’ and ‘Time to Docs’. CACE Partners was engaged to assist with a complete end-to-end redesign of the mortgage process and transform the way lending was undertaken.

APPROACH

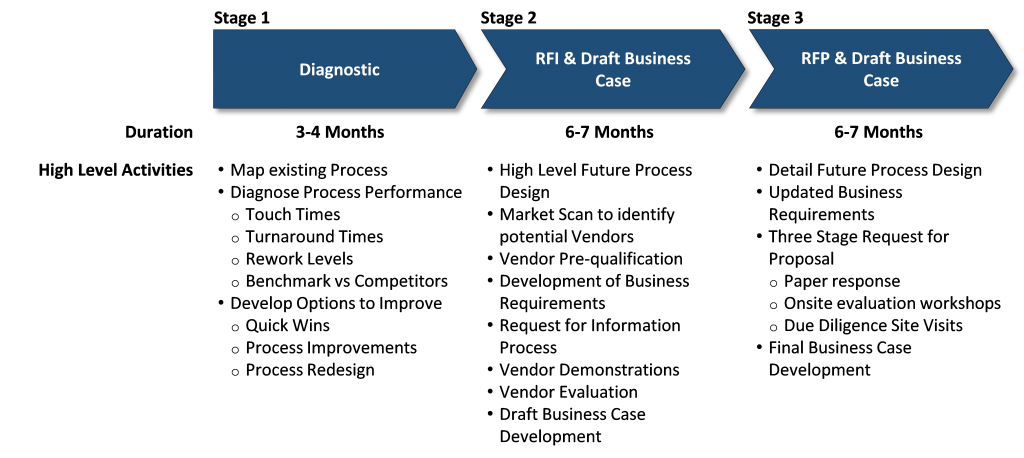

Over the course of 18 months, a joint CACE Partners and client team worked to deliver the client’s largest project at the time. Over three phases, we delivered:

- Pre-Work: Designing a structured approach to the-end-to-end process redesign

- Diagnostic: Developing the appropriate frameworks, factbase and metrics to understand the current state of the process

- RFI: Assisting with vendor evaluation (both financial and non-financial) and negotiation strategy

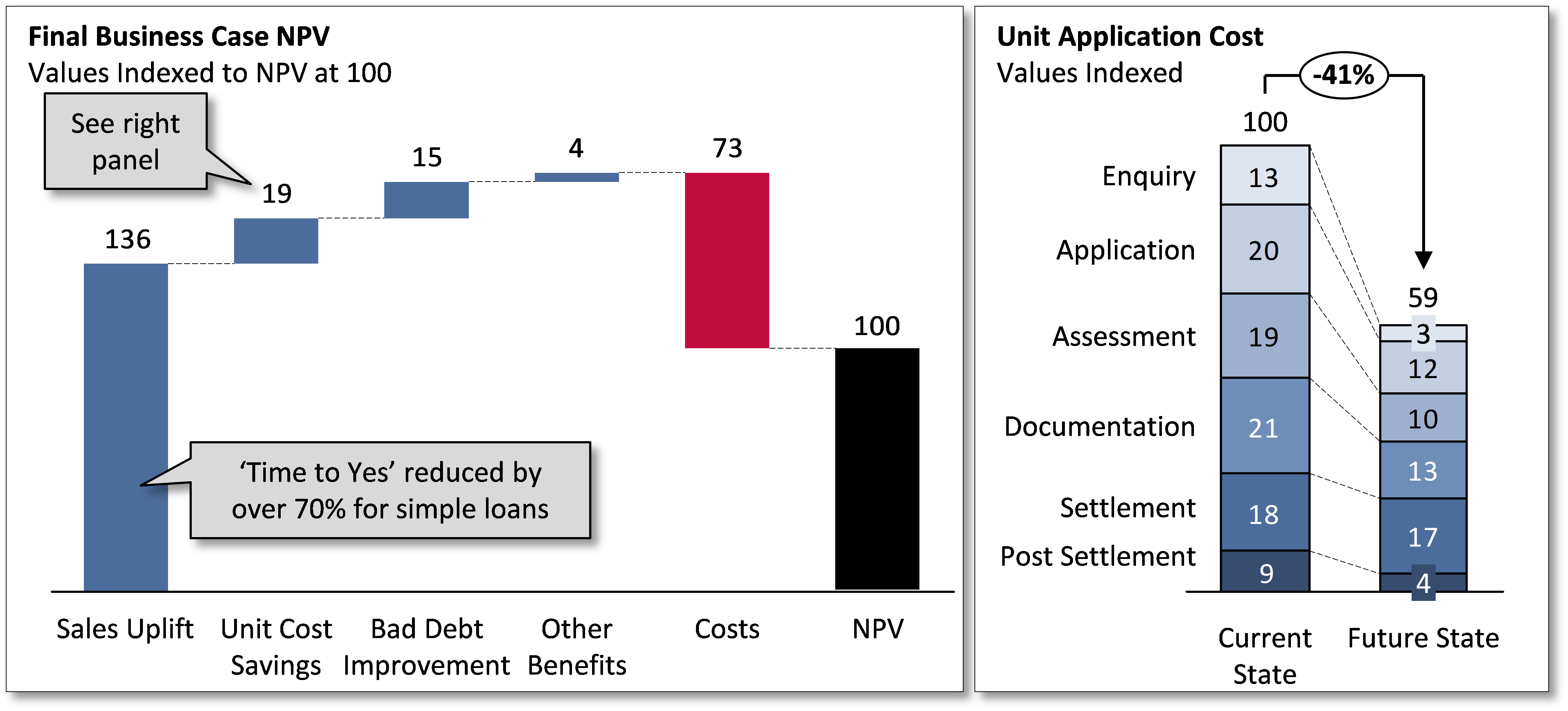

- Business Case (Draft and Final): Leading the overall development of the business case including financial modelling, bottom up end-to-end identification of benefits, and preparation of business case materials for the Board of Directors for sign-off

RESULTS

The final business case yielded significant financial benefits: