CONTEXT

Our client, a major Australian bank, was under-performing across several key aspects of its retail and commercial banking businesses—declining margins, small and declining market share in its core products, high cost to income ratio, poor customer satisfaction and unacceptable employee engagement. CACE Partners was engaged to assist the client in achieving a step change in its cost structure whilst at the same time improving revenue, margins, customer satisfaction and employee engagement.

INSIGHTS / APPROACH

A joint CACE Partners/client team adopted a structured strategic cost reduction approach across the entire bank.

The key steps in the adopted approach included:

- The development of a market competitive cost-to-income ratio required over each of the following three years

- The translation of the cost-to-income ratios to absolute dollar cost targets required over each of the following three years, based on forecast income levels and target returns on equity

- The application of a structured cost reduction methodology across the entire bank to identify initiatives to achieve the required absolute cost structure. The methodology focussed on six key work streams

- Organisational structure optimisation

- End-to-end process improvement, particularly for mortgages and commercial loans

- Operations consolidation & optimisation

- IT operating model

- Support functions / shared services Improvement

- Non-FTE spend reduction.

- The design of the go-forward approach and capability for Process Management across the Bank

- The development of implementation plans and the setup of a programme management office to drive implementation of initiatives and track key benefits

Results

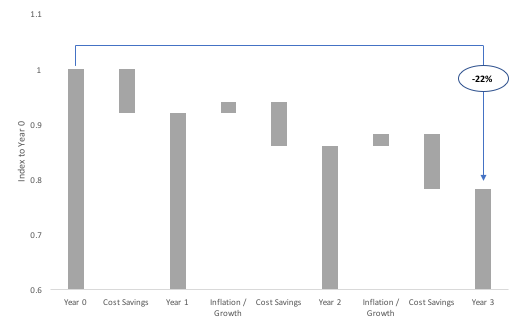

The programme identified reductions in operating costs across the bank that over three years, once inflation was offset, reduced the banks cost by 22%.