The initial three-year programme achieved a reduction of over 25% over the three-year time horizon.

CONTEXT

Our client, a major Australian/NZ insurance and wealth management company, was facing serious strategic and financial challenges and needed to undertake a transformation of its business. CACE Partners was engaged to assist the client in achieving a step change in its cost structure whilst at the same time nearly doubling revenue, increasing adviser and customer satisfaction and improving employee engagement. Our first engagement of three years involved the design and implementation of a 3 year strategic cost reduction program to reduce absolute costs by 25%. Our second engagement of eighteen months involved the design and implementation of a strategic cost reduction program to reduce absolute costs by a further 10% over 2 years.

INSIGHTS / APPROACH

For both engagements, a joint CACE Partners/client team adopted a structured strategic cost reduction approach across all areas of the client’s Australian and NZ operations.

The key steps in the adopted approach included:

- the development of a market competitive cost-to-income ratio required over each of the following three years in the first engagement and two years in the second engagement

- the translation of the cost-to-income ratios to absolute dollar cost targets required over each of the following three years for the first engagement and two years for the second engagement, based on forecast income levels and target returns on equity

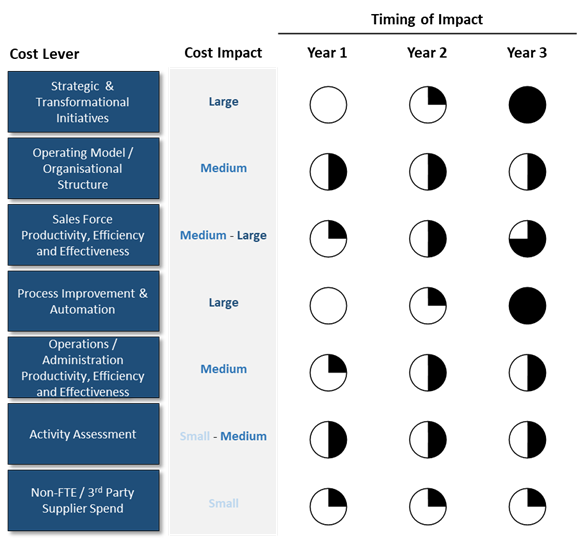

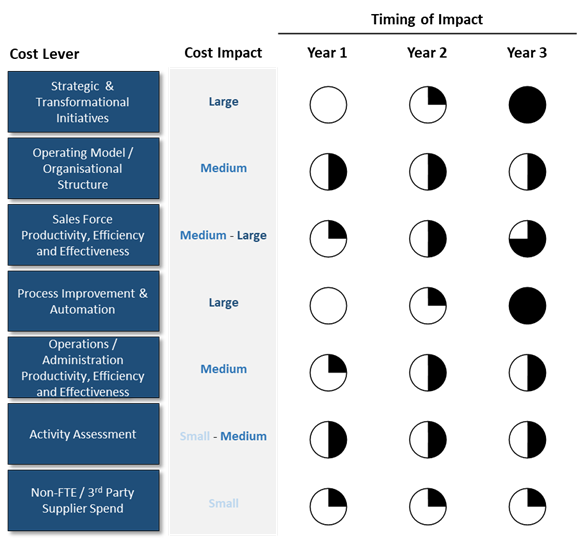

- the application of a structured cost reduction methodology across the entire organisation to identify initiatives to achieve the required absolute cost structure. The methodology focused on seven key work streams

- Strategic/Transformational opportunities

- Operating Model/Organisation structure optimisation

- Sales force productivity and efficiency improvement

- End-to-end process improvement & automation

- Operations consolidation & efficiency improvement

- Elimination of low/no value activities across the organisation

- Non-FTE/3rd party spend reduction

- the development of implementation plans and the setup of a programme management office to drive implementation of initiatives and track key benefits

RESULTS

The initial three-year programme achieved a reduction of over 25% over the three-year time horizon. The succeeding programme achieved a further reduction of nearly 15% over the two-year time horizon.

The achievement of the cost reductions utilised all seven levers. In the early years of the programme, the reduction in costs were achieved through low/no-IT initiatives, principally through non-FTE reductions, support function consolidation between Australia and NZ, elimination of low/no value activities, elimination of a layer of middle management and the sale of non-core assets. The later year cost reductions were achieved largely through the automation and redesign of key end-to-end processes, the outsourcing of several operational activities to lower cost locations and the outsourcing of several IT activities to a global third party.

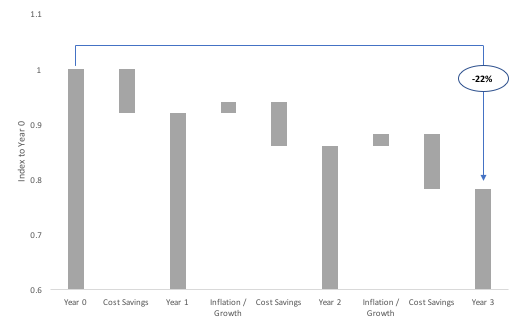

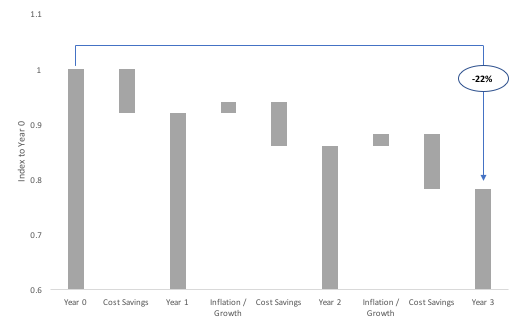

The programme identified reductions in operating costs across the bank that over three years, once inflation was offset, reduced the banks cost by 22%.

CONTEXT

Our client, a major Australian bank, was under-performing across several key aspects of its retail and commercial banking businesses—declining margins, small and declining market share in its core products, high cost to income ratio, poor customer satisfaction and unacceptable employee engagement. CACE Partners was engaged to assist the client in achieving a step change in its cost structure whilst at the same time improving revenue, margins, customer satisfaction and employee engagement.

INSIGHTS / APPROACH

A joint CACE Partners/client team adopted a structured strategic cost reduction approach across the entire bank.

The key steps in the adopted approach included:

- The development of a market competitive cost-to-income ratio required over each of the following three years

- The translation of the cost-to-income ratios to absolute dollar cost targets required over each of the following three years, based on forecast income levels and target returns on equity

- The application of a structured cost reduction methodology across the entire bank to identify initiatives to achieve the required absolute cost structure. The methodology focussed on six key work streams

- Organisational structure optimisation

- End-to-end process improvement, particularly for mortgages and commercial loans

- Operations consolidation & optimisation

- IT operating model

- Support functions / shared services Improvement

- Non-FTE spend reduction.

- The design of the go-forward approach and capability for Process Management across the Bank

- The development of implementation plans and the setup of a programme management office to drive implementation of initiatives and track key benefits

The SMA has attracted ~$1B in new funds since deployment.

CONTEXT

Our client, a leading Australian wealth manager and financial services provider, was keen to understand the opportunities available in the emerging Separately Managed Account (SMA) platform space. The client had a large existing business spread across 2 existing platforms – an older master trust, and a newer wrap platform. It was receiving feedback from its financial adviser force that its existing platforms were not flexible enough to manage the breadth of assets in which clients were seeking to invest.

APPROACH

CACE Partners developed a market entry strategy, using a hypothesis driven approach, to enable the client to understand the opportunities and risks associated with the development of a new SMA platform. Once the strategy was approved by the executive team, a collaborative team of CACE Partners, seconded client staff and a few contracted SMEs was assembled to specify the market offering and develop / source the required technology, processes and tools. A pilot offering was soft launched with a selected group of advisers to test and refine the offering. The pilot approach provided invaluable insights, which were incorporated into the commercial product specification. Once the offer was finalised a commercially robust and highly scalable version was developed for broad rollout.

RESULTS

The SMA has attracted ~$1B in new funds since deployment.

Over the course of 18 months, a joint CACE Partners and client team worked to deliver the client’s largest project at the time.

CONTEXT

Our client, a major Australian Bank, was severely underperforming in its core mortgage product. It experienced below system mortgage growth in a rapidly expanding market, poor relative market share and higher than average levels of non-performing loans. Constrained by an end-to-end mortgage process that was highly manual and paper based, and that was underpinned by antiquated systems, its mortgage offer could not competitively satisfy key customer buying criteria, particularly with respect to its ‘Time to Yes’ and ‘Time to Docs’. CACE Partners was engaged to assist with a complete end-to-end redesign of the mortgage process and transform the way lending was undertaken.

APPROACH

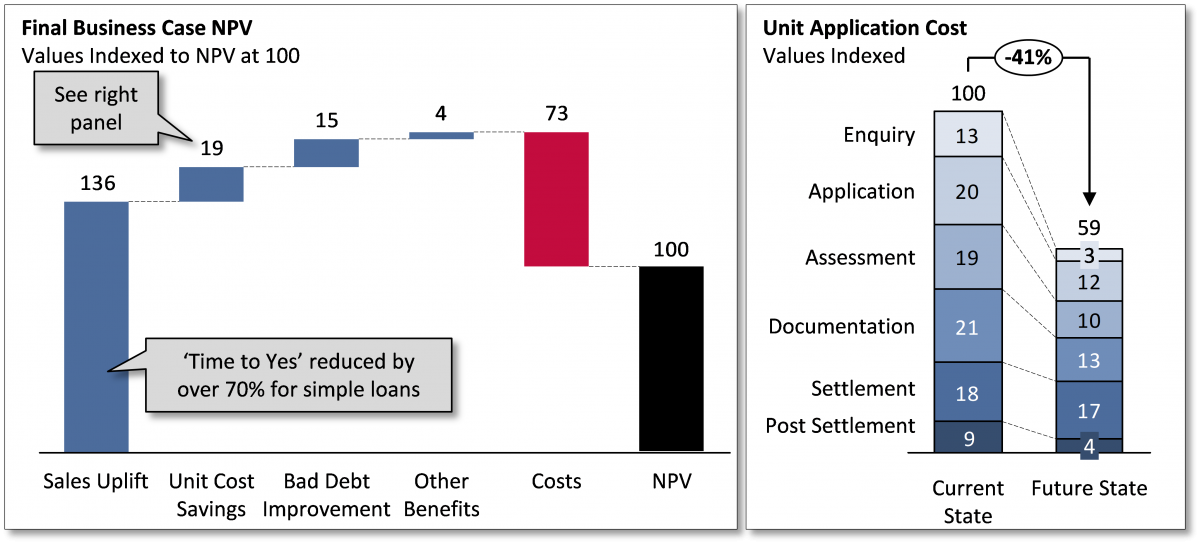

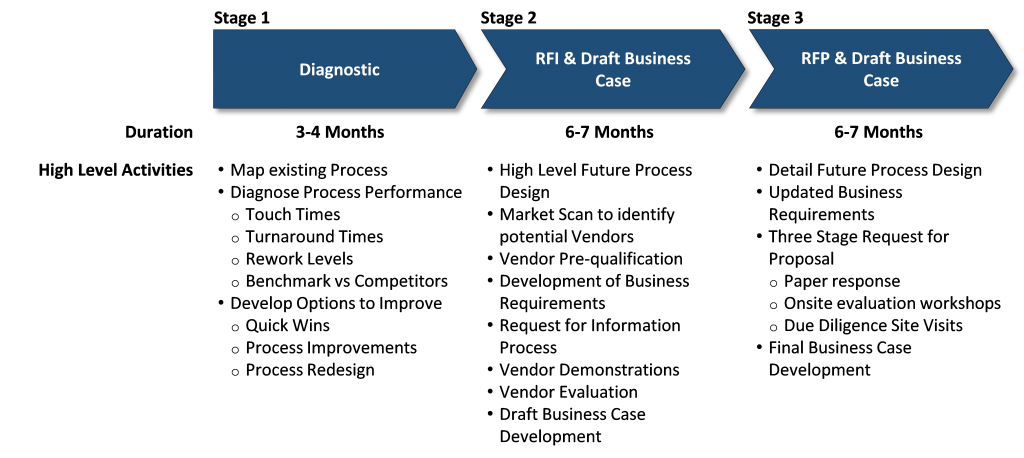

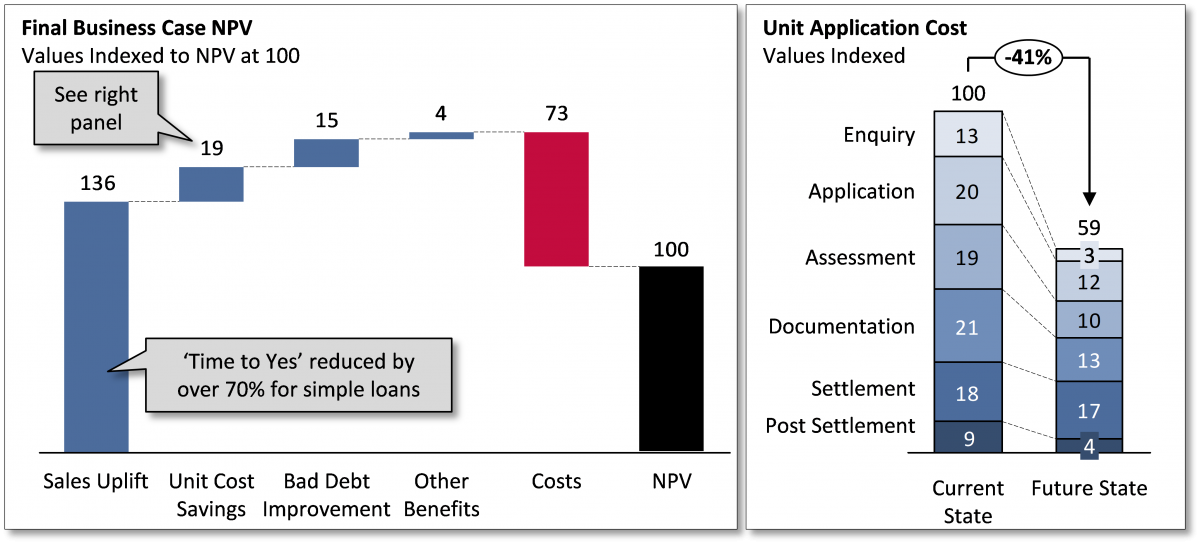

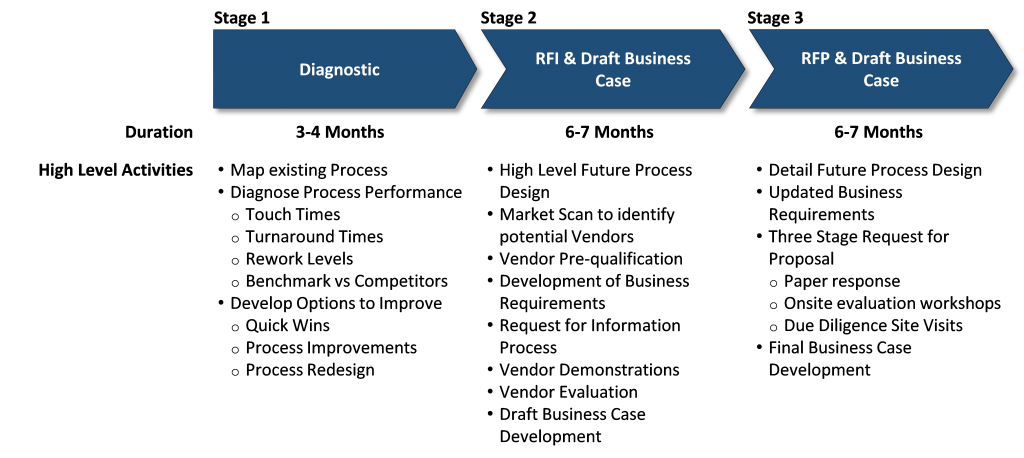

Over the course of 18 months, a joint CACE Partners and client team worked to deliver the client’s largest project at the time. Over three phases, we delivered:

- Pre-Work: Designing a structured approach to the-end-to-end process redesign

- Diagnostic: Developing the appropriate frameworks, factbase and metrics to understand the current state of the process

- RFI: Assisting with vendor evaluation (both financial and non-financial) and negotiation strategy

- Business Case (Draft and Final): Leading the overall development of the business case including financial modelling, bottom up end-to-end identification of benefits, and preparation of business case materials for the Board of Directors for sign-off

RESULTS

The final business case yielded significant financial benefits:

Overall operating costs reduced by 29%, after allowance for inflation, whilst service level adherence improved and rework levels plummeted.

CONTEXT

Our client, the operations area of a large Australian wealth management business, was experiencing increasing unit costs, poor service outcomes to customers and increasing rework rates. The CEO engaged CACE Partners to undertake a review of the operations areas to reduce absolute costs in the two operations centres by 20% whilst improving customer service and rework rates.

INSIGHTS / APPROACH

CACE Partners undertook a diagnostic to understand four key elements:

- Transaction volume trends

- Cost structure – operating costs, FTE’s and unit costs (cost per transaction)

- Service metrics and trends – percentage of work items processing within both internal and external service level agreements

- Quality metrics and trends – percentage of errors captured by rework and external reporting.

The diagnostic quickly identified the need for the development and implementation of a management toolkit. The management and staff in the operations areas lacked transparency in key cost, service and quality measures. Thus, they were unable to manage their areas based on data/facts.

CACE Partners worked with the client to introduce a management toolkit with the following key characteristics:

- All activities within the operations areas were broken down into three groups (core workflow, core non-workflow, overhead)

- Productivity targets by activity (expected effort time) were developed for each activity within each group via a combination of data analysis and activity observation

- Data capture tools and forecasting, planning and reporting was established at an individual, team, area and department level

- A mixture of formal training and on the floor coaching was provided to team members and managers to deploy the approach over a 3-month period, supported by an extensive communication strategy

- Managers were measured on their maturity on a weekly basis as they obtained mechanical, conceptual and then ownership compliance of the tools and processes to achieve behavioural change in their teams.