The CACE Partners collaborative cost reduction approach was deployed to ensure management and staff were involved throughout.

CONTEXT

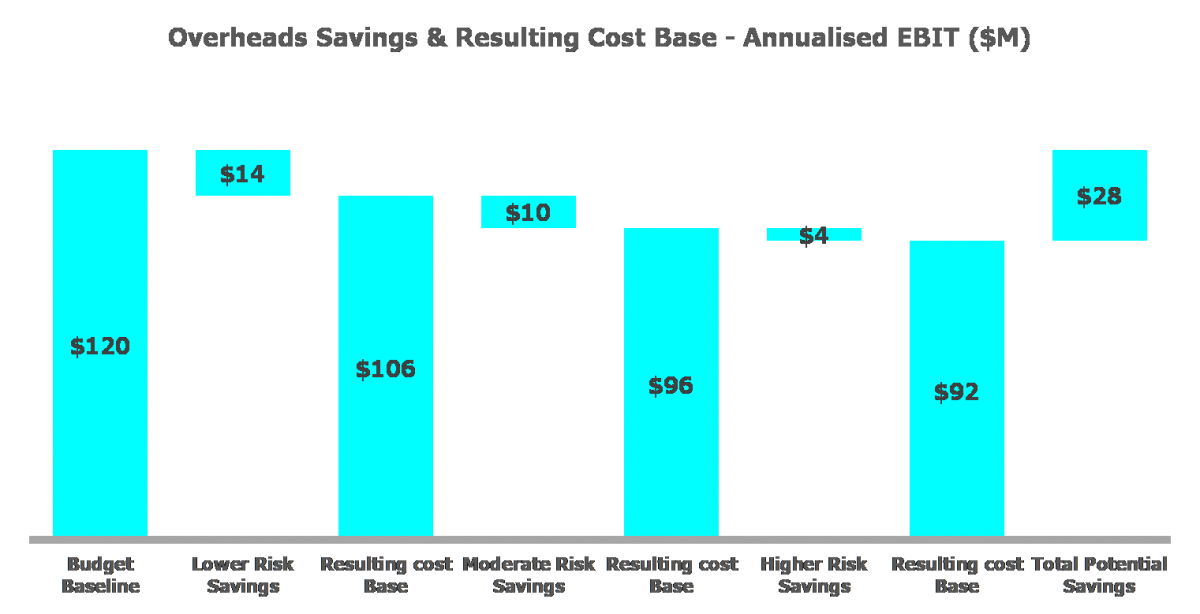

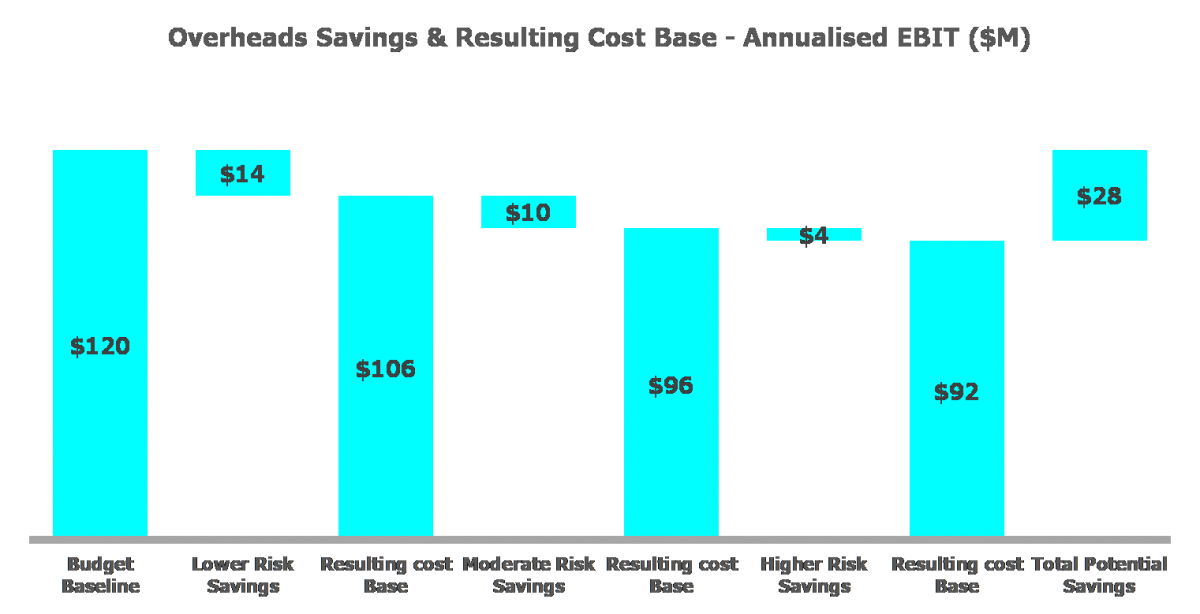

A leading Australian FMCG manufacturer was seeking to reduce overhead costs in response to revenue and margin pressure in its core categories. CACE Partners was engaged to assist the client reduce its overheads without damaging the business and in a way that didn’t alienate staff and destroy culture and goodwill. Specifically, the client wanted to ensure the savings were reasonable and sustainable, reflective of the environment in which they operated.

INSIGHTS / APPROACH

The CACE Partners collaborative cost reduction approach was deployed to ensure management and staff were involved throughout. Key process steps included –

- Agreed the savings target and supporting rationale

- Understood the business strategy for the next 3 years, to ensure resulting cost structure was aligned

- Broke the target down by business area and cost centre, adjusted to align with strategy

- Ran a series of workshops with management to develop savings hypotheses

- Applied a transparent and consistent risk assessment framework to all savings, aligned to business strategy

- Worked with the executive team to agree which savings were considered low or moderate risk, and which would only be pursed in the case of a ‘gloom’ or ‘doom’ scenario

- Built analytical support to quantify savings over following 3 years & steps required to implement

- Built implementation plans for all approved savings initiatives and supported finance team to load budgets

- $24M (21%) total, risk assessed savings identified, with $22M (19%) loaded into budgets

RESULTS

A set of discrete actions were built into an implementation plan with owners, deliverables, required resources and deliverables assigned to each.

CONTEXT

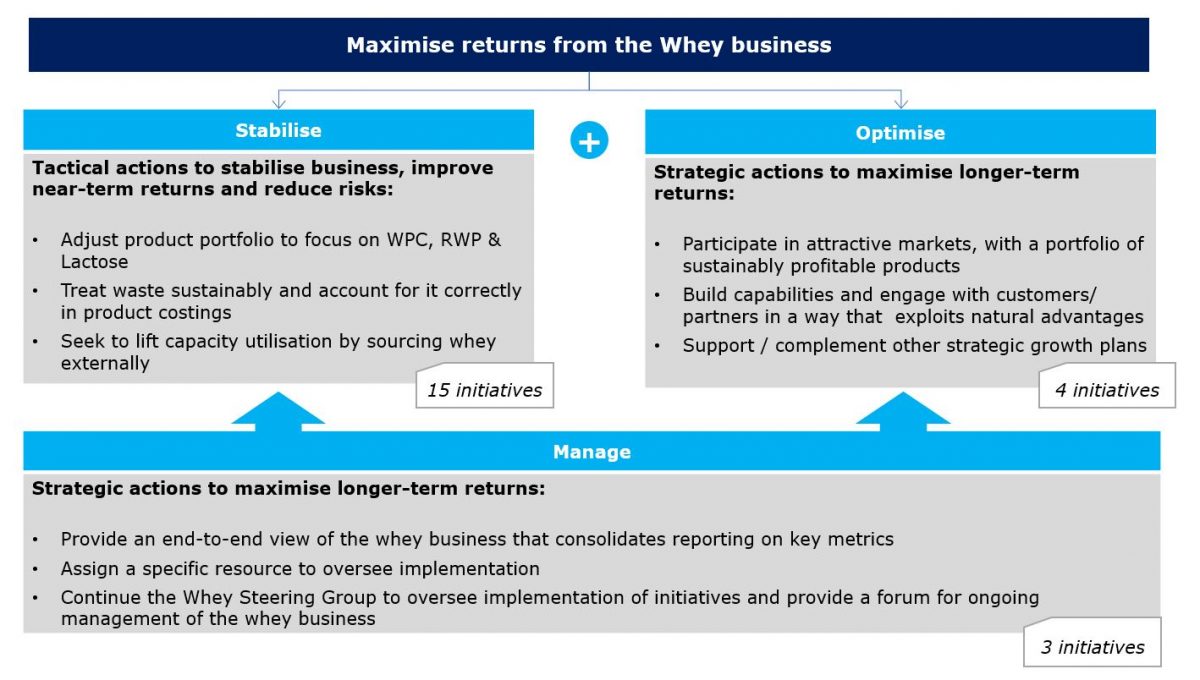

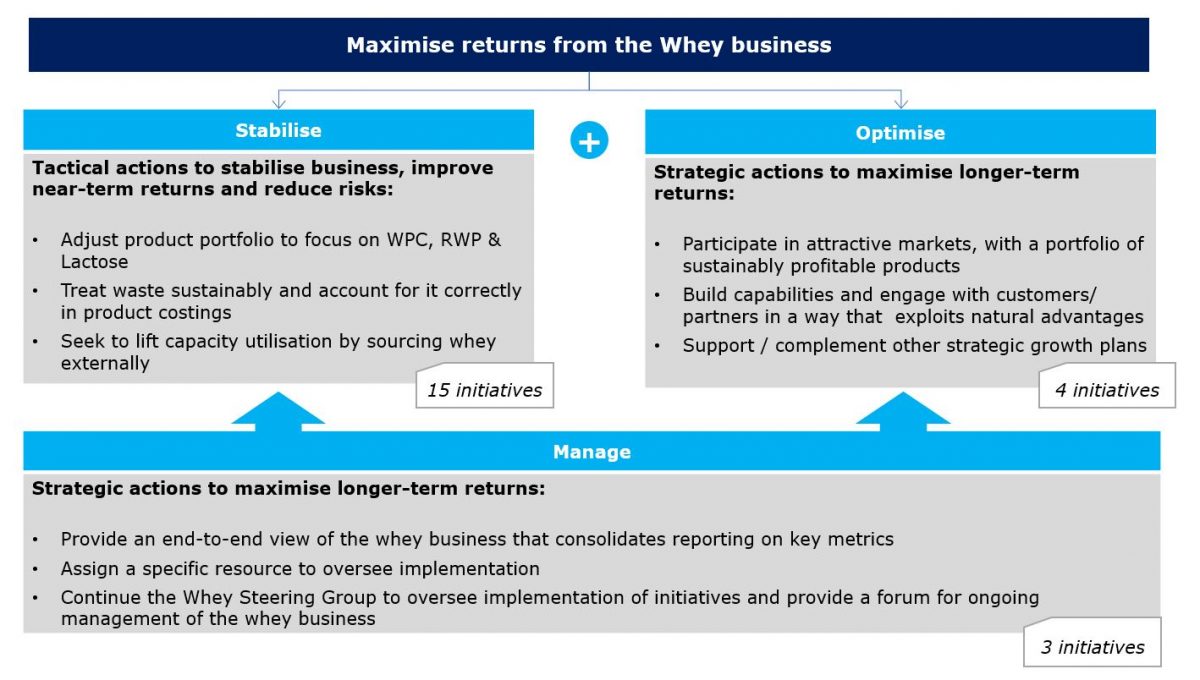

Our client, a large Australian dairy processor, had a large legacy position in whey, as a by-product of its significant cheese production operations. Management were unsure how best to handle whey, as it presented both an environmental and operational risk, and a commercial opportunity with several large, profitable industrial relationships. CACE Partners were asked to help them understand the risk and rewards associated with whey, and to develop a strategic action plan.

INSIGHTS / APPROACH

Small CACE Partners team worked across all aspects of the whey value chain to understand the operational and environmental issues and the sales and product opportunities. The problem was multi-faceted, involving remedial costs in the near terms, and significant value and opportunities longer term. A disciplined financial and non-financial assessment process was used to understand the costs, revenues and value of the whey asset over a 5-year timeframe.

A set of discrete actions were built into an implementation plan with owners, deliverables, required resources and deliverables assigned to each. A tracker was also built to ensure management maintained focus and momentum.

RESULTS

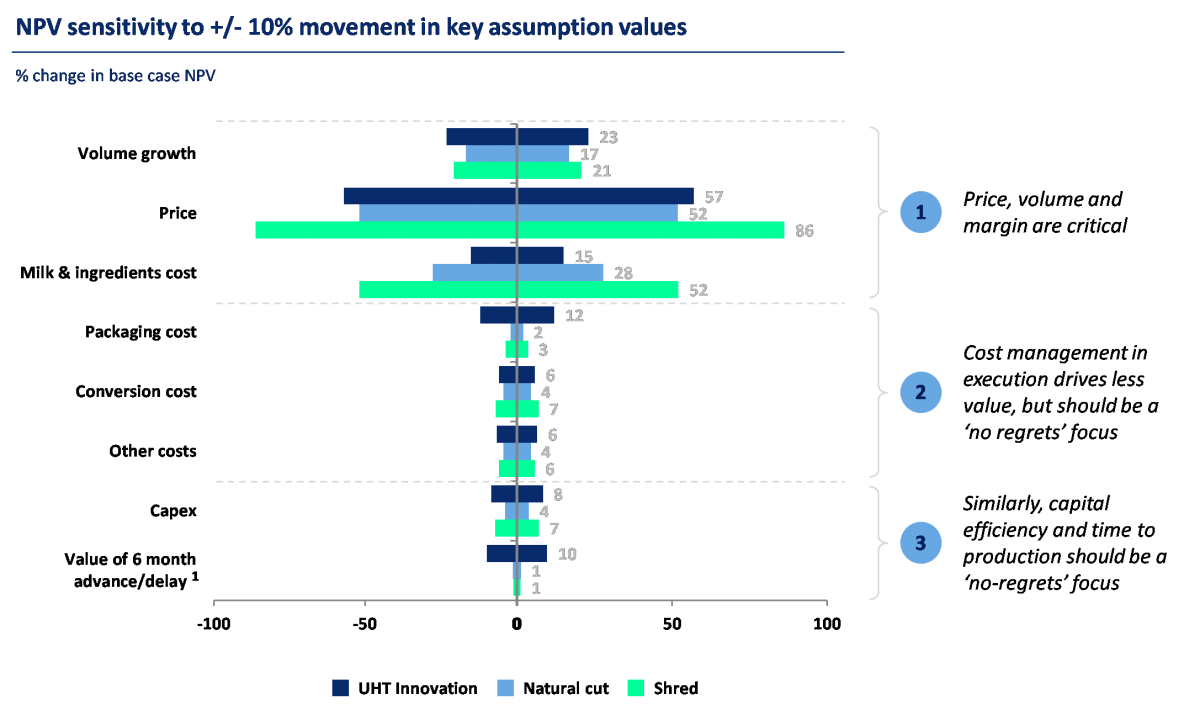

A small CACE Partners team worked with management to build an investment hypothesis, detailing the key elements of the proposed investment.

CONTEXT

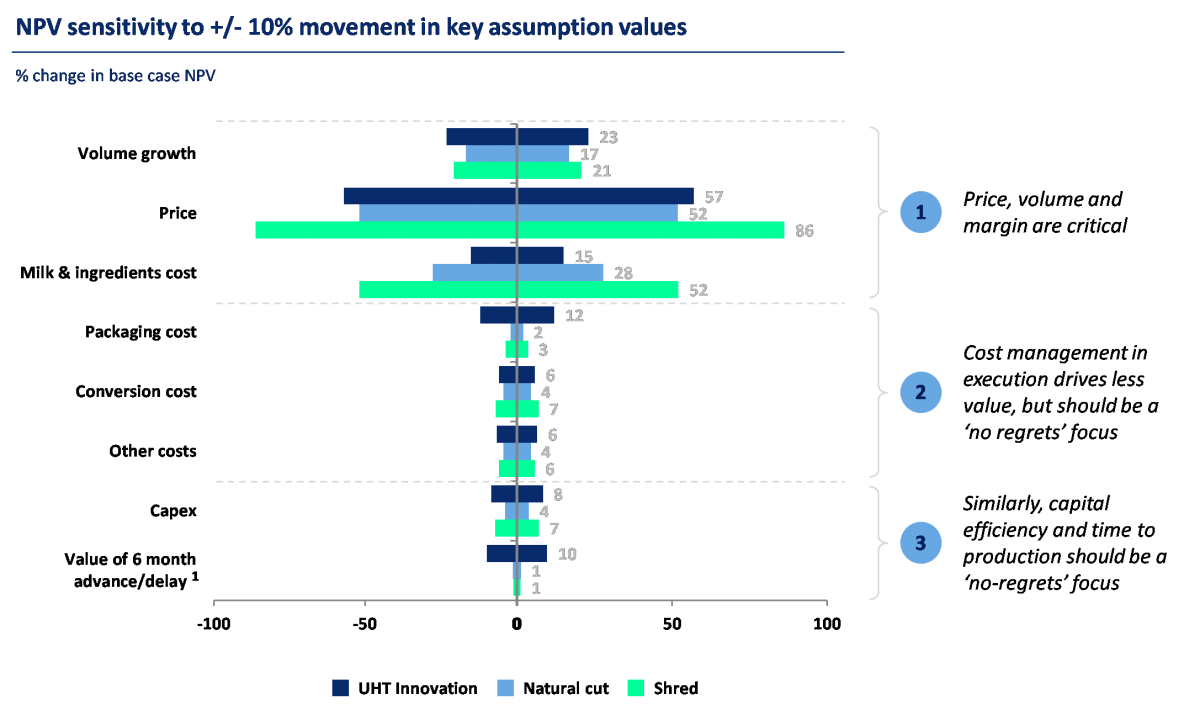

Our Client, a large Australian dairy processor, was considering a series of large investments to transform its manufacturing capacity and capabilities. Plans were well progressed when CACE Partners was asked to assist management re-look at the business case, to ensure the investment made sense before presenting to the Board.

INSIGHTS / APPROACH

A small CACE Partners team worked with management to build an investment hypothesis, detailing the key elements of the proposed investment. A set of key ‘what do we need to believe’ assumptions were then fleshed out, which identified key risks and requirements. A practical approach to sensitivity analysis quickly identified the handful of key assumptions that were critical to the investment meeting its promised returns.

Whilst management were most worried about build cost overruns, returns were most sensitive to export sale prices and volumes. These critical assumptions could then be tested in a rapid and low-cost way, to assess / improve confidence and de-risk the project. Each of 7 investments were assessed in this way, with a number being shelved once it was clear the required volumes and prices were unlikely to be achieved, and with lower cost workarounds developed.

RESULTS

A highly collaborative approach was taken to leverage management and SME expertise.

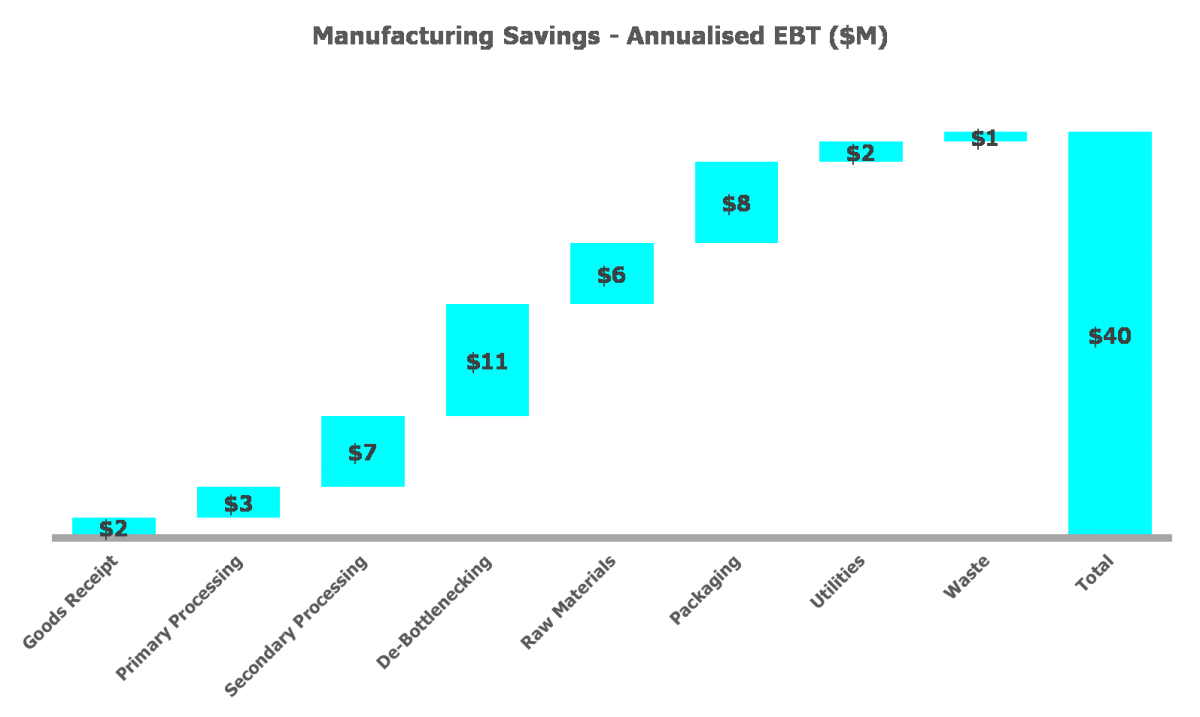

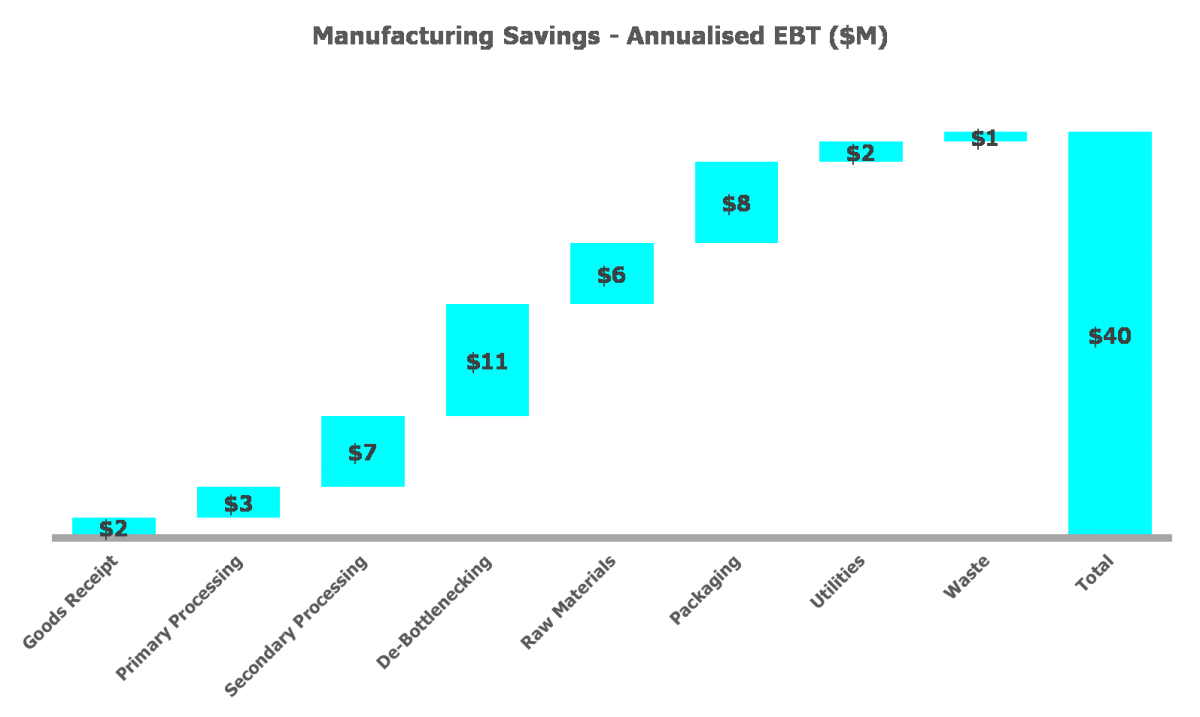

CONTEXT

Our client, a leading Australian FMCG manufacturer and packaged fruit processor, was faced with a large legacy manufacturing cost base, which was impacting competitiveness in the face of falling volumes in its core products. Specifically, the client was keen to understand the opportunities to reduce the cost impact of seasonality on its business, whilst also reducing manufacturing costs in general.

CACE Partners was engaged to work with management to develop a strategy to de-seasonalise operations and to identify opportunities reduce manufacturing costs.

INSIGHTS / APPROACH

A highly collaborative approach was taken to leverage management and SME expertise:

- End to end manufacturing strategy developed to significantly reduce the cost impact of seasonality on the business

- 10 workstream established across operations and supply chain

- Collaborative idea generation workshops held in each stream

- 200+ saving hypotheses identified for assessment

- Collaborative approach included risk assessment of each initiative, with a management owner appointed for each hypothesis taken through to exco for approval

- 50+ hypotheses taken through to exco approval and included in the capital masterplan

- $35M+ in annualised operational savings (~15% of operational cost base)

RESULTS