The SMA has attracted ~$1B in new funds since deployment.

CONTEXT

Our client, a leading Australian wealth manager and financial services provider, was keen to understand the opportunities available in the emerging Separately Managed Account (SMA) platform space. The client had a large existing business spread across 2 existing platforms – an older master trust, and a newer wrap platform. It was receiving feedback from its financial adviser force that its existing platforms were not flexible enough to manage the breadth of assets in which clients were seeking to invest.

APPROACH

CACE Partners developed a market entry strategy, using a hypothesis driven approach, to enable the client to understand the opportunities and risks associated with the development of a new SMA platform. Once the strategy was approved by the executive team, a collaborative team of CACE Partners, seconded client staff and a few contracted SMEs was assembled to specify the market offering and develop / source the required technology, processes and tools. A pilot offering was soft launched with a selected group of advisers to test and refine the offering. The pilot approach provided invaluable insights, which were incorporated into the commercial product specification. Once the offer was finalised a commercially robust and highly scalable version was developed for broad rollout.

RESULTS

The SMA has attracted ~$1B in new funds since deployment.

A set of discrete actions were built into an implementation plan with owners, deliverables, required resources and deliverables assigned to each.

CONTEXT

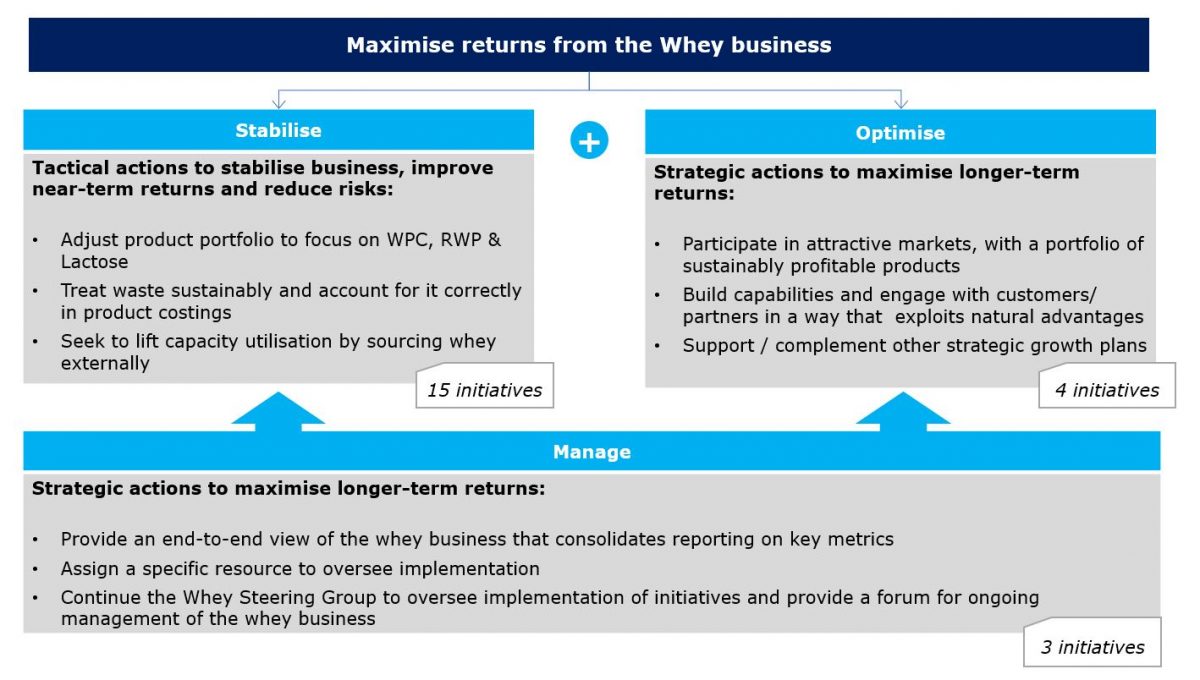

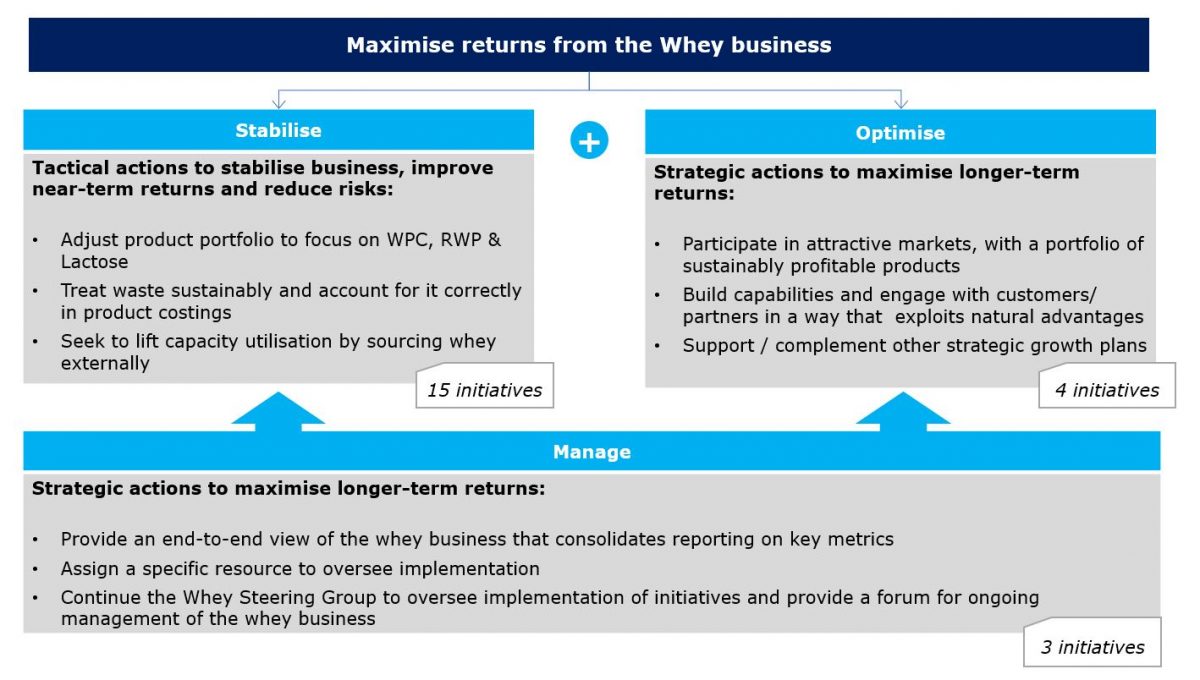

Our client, a large Australian dairy processor, had a large legacy position in whey, as a by-product of its significant cheese production operations. Management were unsure how best to handle whey, as it presented both an environmental and operational risk, and a commercial opportunity with several large, profitable industrial relationships. CACE Partners were asked to help them understand the risk and rewards associated with whey, and to develop a strategic action plan.

INSIGHTS / APPROACH

Small CACE Partners team worked across all aspects of the whey value chain to understand the operational and environmental issues and the sales and product opportunities. The problem was multi-faceted, involving remedial costs in the near terms, and significant value and opportunities longer term. A disciplined financial and non-financial assessment process was used to understand the costs, revenues and value of the whey asset over a 5-year timeframe.

A set of discrete actions were built into an implementation plan with owners, deliverables, required resources and deliverables assigned to each. A tracker was also built to ensure management maintained focus and momentum.

RESULTS

A small CACE Partners team worked with management to build an investment hypothesis, detailing the key elements of the proposed investment.

CONTEXT

Our Client, a large Australian dairy processor, was considering a series of large investments to transform its manufacturing capacity and capabilities. Plans were well progressed when CACE Partners was asked to assist management re-look at the business case, to ensure the investment made sense before presenting to the Board.

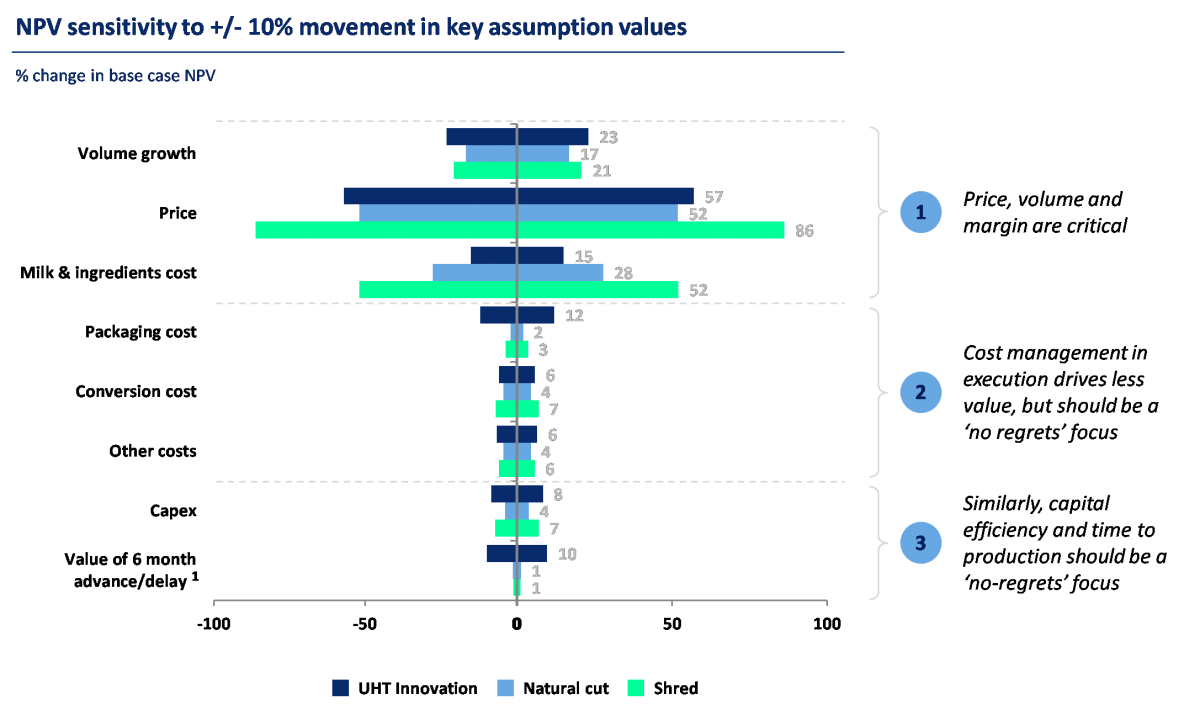

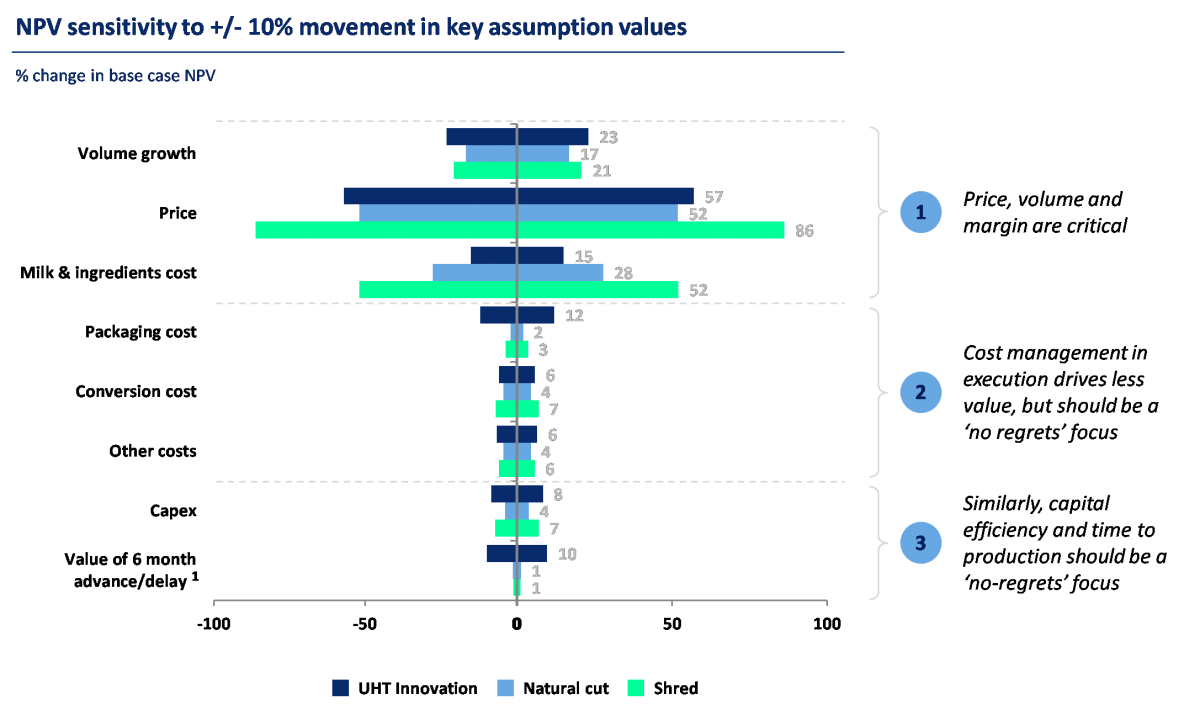

INSIGHTS / APPROACH

A small CACE Partners team worked with management to build an investment hypothesis, detailing the key elements of the proposed investment. A set of key ‘what do we need to believe’ assumptions were then fleshed out, which identified key risks and requirements. A practical approach to sensitivity analysis quickly identified the handful of key assumptions that were critical to the investment meeting its promised returns.

Whilst management were most worried about build cost overruns, returns were most sensitive to export sale prices and volumes. These critical assumptions could then be tested in a rapid and low-cost way, to assess / improve confidence and de-risk the project. Each of 7 investments were assessed in this way, with a number being shelved once it was clear the required volumes and prices were unlikely to be achieved, and with lower cost workarounds developed.

RESULTS